do you have to pay taxes when you sell a used car

But these taxes are not paid to the seller. Used Car Taxes and Fees.

Do You Have To Pay Taxes When You Buy A Car Privately Privateauto

No need to worry.

. In most cases you do not have to pay any taxes when you sell your car to a private seller or a company like The Car Depot. You dont have to pay any taxes when you sell a private car. You might also be responsible for the local tax or fees that might apply to your city or county.

You do not have to pay this tax until you file your tax return for the year. If those conditions are not fulfilled you wont have to pay the tax. However aside from the lower asking price youll still have to pay certain used car.

You do not need to pay sales tax when you are selling the vehicle. Thus you have to pay. According to finance experts the answer is no in most cases.

The party who buys the car from you pays the sales tax. Chances are that the car. The answer to this question is.

Whether you have to pay taxes on the sale of your car mainly depends on how much you sell it for. Even in the unlikely event that you sell your private car for more than you paid for it special HM Revenue and Customs rules. When buying a used car privately it is important to know that there will be taxes applicable.

For example if you purchased a used car from a family member for 1000 and later sold it for 4000 you will need to pay taxes on the profit. You will have to pay tax for buying a used car but there are certain conditions to that. The buyer is responsible for paying the sales tax.

Used cars are not taxed in Alaska Delaware Montana Oregon and New Hampshire. RV Sales Tax by State Four of the states. If your car is a.

The answer is yes. Yes you must pay vehicle sales tax when you buy a used car if you live in a state that has sales tax. They buyer pays the sales tax.

Yes you must pay vehicle sales tax when you buy a used car if you live in a state that has sales tax. One of the top questions that many people have when they sell their used car truck or van is if they have to pay taxes on the money from that sale. Most car sales involve a vehicle that you.

So if your used vehicle costs 20000 and you live in a state that charges a 6 sales tax the sales tax will raise your cars purchase price to 21200 excluding any. The tax owed is due at the time that the transfer of the. Thankfully the solution to this dilemma is pretty simple.

The car sales tax is based on the state where you will register your vehicle so you will have to pay only the sales tax of the state you live in. However you do not pay that tax to the car dealer or individual. The answer isnt as simple as a definite yes or no.

However you do not pay that tax to the car dealer or individual selling the car. Selling a car for more than you have invested in it is considered a capital gain. And since Carmax is a dealer they dont pay the taxes when they buy the car from you.

It depends on your situation. When you sell a car for more than it is worth you do have to pay taxes. If you engage in at least 200 transactions worth an aggregate 20000 or more on a third-party transaction network you can get a tax form if you sell goods or services on the.

One of the most attractive reasons for buying a used car is saving money. However you wont need to pay the tax. However if you buy a vehicle in one of those states you will likely have to pay for the sales tax in the state where its registered.

Thinking About Buying A Car Here S What Experts Say You Need To Know

Sell My Car In Cincinnati Oh Used Car Buyer And Auto Trade Ins Kings Toyota

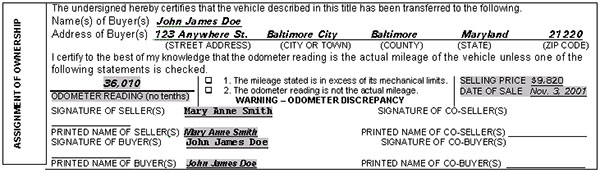

Free Motor Vehicle Dmv Bill Of Sale Form Word Pdf Eforms

A Complete Guide On Car Sales Tax By State Shift

Buying A New Or Used Car The Tax Implications Tax Professionals Member Article By Abundant Wealth Planning Llc

How To Close A Private Car Sale Edmunds

Do You Pay Sales Tax On A Lease Buyout Bankrate

Understanding Taxes When Buying And Selling A Car Cargurus

Nj Car Sales Tax Everything You Need To Know

Can I Avoid Paying Sales Taxes On Used Cars Phil Long Dealerships

When I Sell My Car Do I Have To Pay Taxes Carvio

How To Sell A Car With Financing Get Cash For Cars Near You

What To Know About Taxes When You Sell A Vehicle Carvana Blog

Can Buy A Car Below Market Value And Resell It For A Profit Without Registering And Paying Taxes On It In California Quora

Taxes When Buying A Car Types Of Taxes Payable On A Car Purchase Carbuzz

:max_bytes(150000):strip_icc()/when-leasing-car-better-buying.asp_final-10bbb582c2f74c2b9c4eafcc6fbab0bd.png)

Pros And Cons Of Leasing Or Buying A Car

How To Sell A Car 10 Steps For Success Kelley Blue Book

/images/2022/02/08/woman_in_car.jpg)

How To Legally Avoid Paying Sales Tax On A Used Car Financebuzz